The Importance of Strong Credit for Securing Mortgages

Are you looking to buy a new home or refinance your current mortgage? If so, one of the most important factors that will determine your eligibility for a mortgage is your credit score. Having a strong credit score can not only increase your chances of getting approved for a mortgage, but it can also lower your interest rate and save you thousands of dollars over the course of your loan. In this article, we will discuss the importance of having a strong credit score when it comes to securing a mortgage, and how you can improve your credit to get the best possible terms for your loan.

The Role of Credit in the Mortgage Process

When you apply for a mortgage, lenders consider several factors to determine your eligibility and interest rate. Your credit score is one of the most significant factors, and it reflects your past credit behavior and how likely you are to repay your debts in the future. A higher credit score indicates a lower risk for the lender, which translates to a better chance of getting approved for a mortgage and a lower interest rate.

Credit Score Requirements for Different Types of Mortgages

While there is no set credit score requirement for a mortgage, most lenders have their own guidelines. Conventional mortgages, which are not insured by the government, usually require a credit score of at least 620. However, a score of 740 or higher can give you the best rates and terms. On the other hand, government-backed mortgages, such as FHA loans, may have more lenient credit score requirements, but a higher credit score can still help you secure a better interest rate.

How a Strong Credit Score can Benefit You

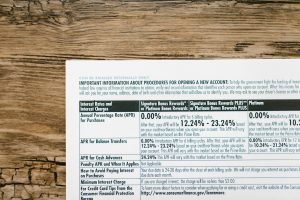

Lower Interest Rates

The most significant advantage of having a strong credit score when applying for a mortgage is lower interest rates. Lenders use interest rates to compensate for the risk they take on by lending you money. With a higher credit score, you are seen as a lower risk borrower, and as a result, you can secure a lower interest rate. For example, a borrower with a credit score of 760 or higher may qualify for an interest rate of 3.5%, while someone with a score of 620 may end up with a rate of 5%. A difference of just 1.5% can equates to thousands of dollars in savings over the life of a mortgage.

Lower Down Payment

Having a strong credit score may also allow you to make a lower down payment on your mortgage. While conventional mortgages usually require a down payment of at least 20% to avoid private mortgage insurance (PMI), a good credit score can help you qualify for a lower down payment, as low as 3%. This can be beneficial for first-time homebuyers who may not have enough savings to make a large down payment.

Better Loan Terms

A high credit score not only gets you a lower interest rate and down payment, but it can also help you secure better loan terms. Lenders may be willing to offer you a longer loan term, which can lower your monthly payments, or a larger loan amount if you have a strong credit history. This can make homeownership more affordable and attainable.

How to Improve Your Credit Score for a Mortgage

If your credit score is not as strong as you would like it to be, there are steps you can take to improve it before applying for a mortgage.

Check Your Credit Report

The first step in improving your credit score is to know where you stand. Get a copy of your credit report from the three major credit bureaus (Experian, Equifax, and TransUnion) and review it for errors. If you find any mistakes, dispute them with the credit bureau to have them corrected.

Pay Down Debt

Your credit score is heavily influenced by your credit utilization ratio, which is the percentage of your available credit that you are using. Ideally, you should aim to keep your credit utilization below 30%. Focus on paying down your balances to improve your credit score.

Make Payments on Time

Payment history is the most crucial factor in determining your credit score. Make sure to pay your bills on time consistently to avoid late payments and negative marks on your credit report. Set up automatic payments or reminders to help you stay on track.

Avoid Opening New Credit Accounts

While it can be tempting to open new credit accounts to improve your credit mix, it can also hurt your score in the short term. Each time you apply for a new credit account, it results in a hard inquiry on your credit report, which can lower your score. If you are planning on applying for a mortgage, it’s best to hold off on opening any new accounts until after the loan is secured.

Conclusion

In conclusion, having a strong credit score is essential when it comes to securing a mortgage. It can not only increase your chances of getting approved for a loan, but it can also save you thousands of dollars in interest and fees over the life of your mortgage. If you are planning on buying a home in the near future, it’s crucial to take the necessary steps to improve your credit score first. Follow the tips mentioned above, and you’ll be on your way to securing a mortgage with the best possible terms.